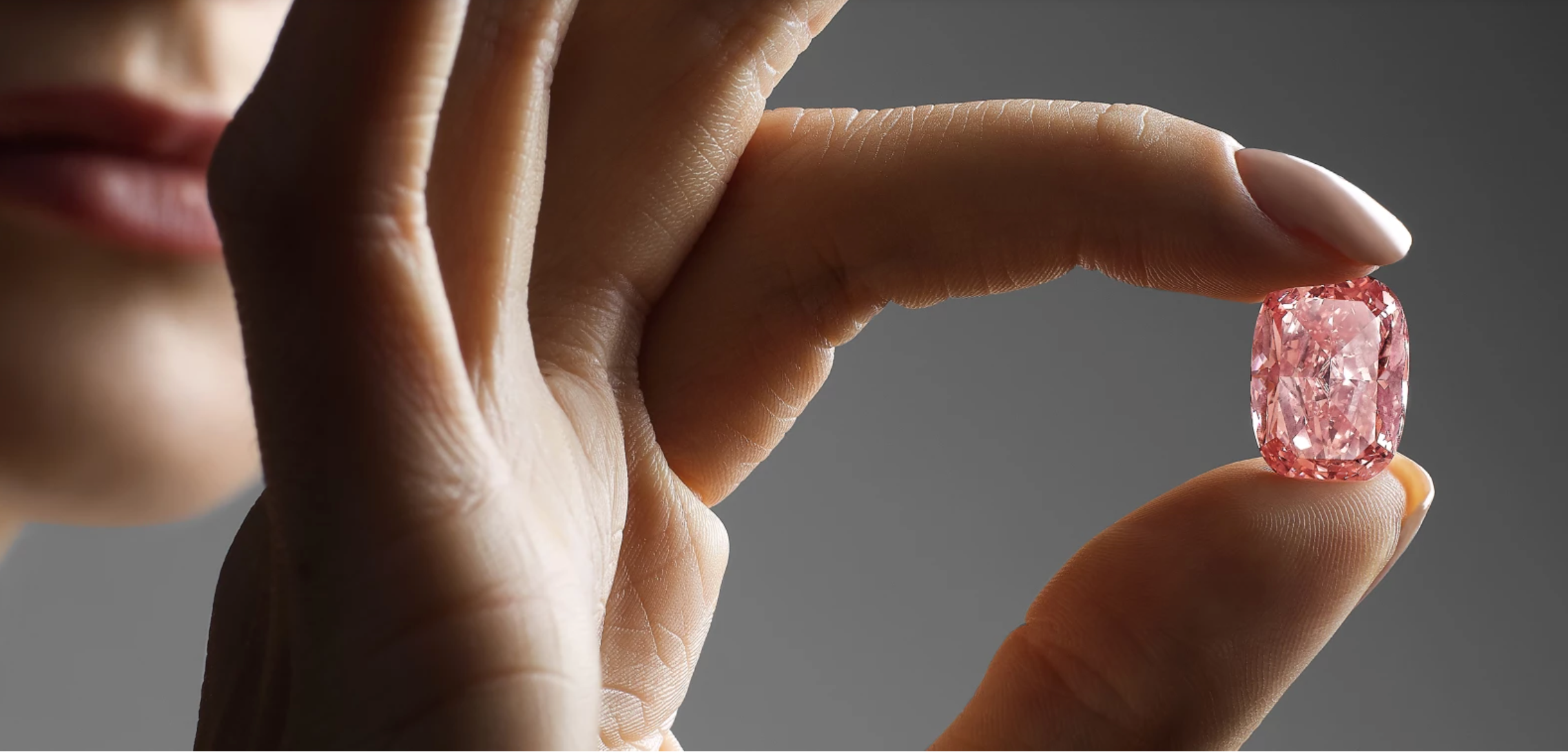

Declining Supply of Pink Diamonds Heralds Increasing Demand and Value in the Marketplace

(Rare Investment Report) Mining conglomerate Rio Tinto announced in early February that it was initiating cost-cutting measures to shore up profitability for its shareholders. Rio Tinto, parent company of the Argyle Mine, is determined to exit the Diamond industry, reducing expenses by US$5 Billion through decreasing its mining efforts and postponing the mine's expansion. What does this mean for Diamond Investors?

Harry Winston - who purchased BHP Billiton's diamond division last November - stated in their fact sheet, that the third quarter of the 2013 fiscal year will see demand for rough diamonds exceed supply, while rough diamond supply will be constrained for the next 7 to 10 years.

Located in the Kimberley region of Western Australia, the Argyle Mine produces over 90% of the world's Pink Diamonds and is the foremost source of these rare stones. Rare Investment is a global source for the world's most rare Natural Fancy Colored Diamonds and the first company in Canada to become an Authorized Partner with the Argyle Mine.

Argyle will continue to extract pink gems out of the mine, but at a slower pace. As a result, experts are recommending that if you have been considering a Pink Diamond, now is the time to purchase, as the demand will continue to rise.

The outlook for the diamond industry suggests that market fundamentals are set to grow increasingly attractive. Harry Winston - who purchased BHP Billiton's diamond division last November - stated in their fact sheet, that the third quarter of the 2013 fiscal year will see demand for rough diamonds exceed supply, while rough diamond supply will be constrained for the next 7 to 10 years.

Rio Tinto's February news release notes, "We expect market uncertainty and price volatility to persist as long as the structural issues in Europe and the United States remain unresolved."

With sustained instability in the market, there is not a better time to capitalize on the opportunity of investing in the world's most beautiful and sought after hard asset investment, rare Natural Fancy Colored Diamonds.