Rob Bates: Pink Diamonds and the Investment Question

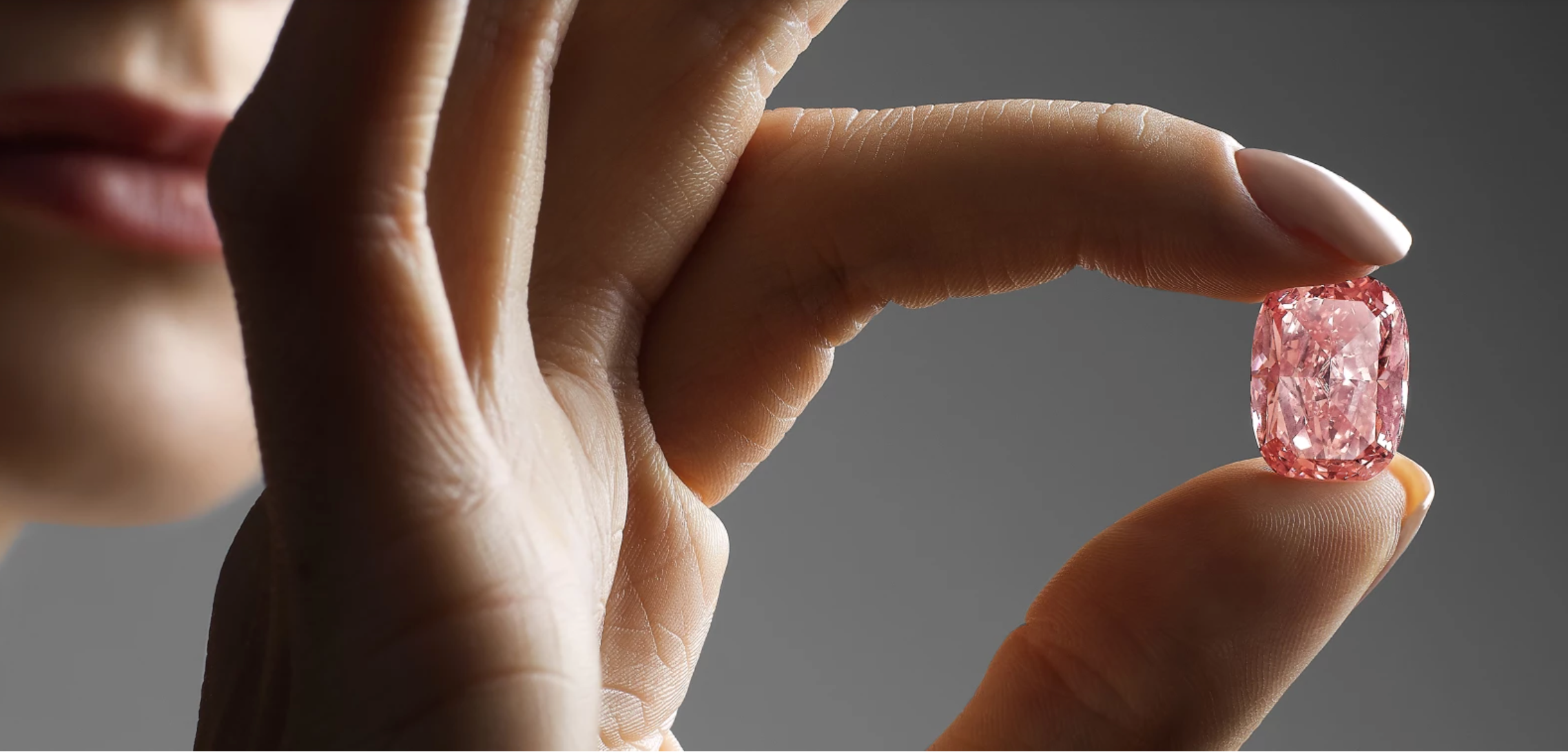

On paper, pink diamonds certainly seem like—and are sometimes touted as—a great investment. For one, they are extremely rare. Speaking at a Natural Colored Diamond Association panel last week, the group’s educational director Thomas Gelb said that just 0.15 percent of the diamonds submitted to the GIA lab are pink. The Argyle mine, which accounts for 90 percent of new pink diamond production and is the only consistent source, will close up shop in five years. According to Argyle Pink Diamonds manager Josephine Johnson, the prices of tender stones have appreciated by double digits over the past 10 years, behaving more like fine art than regular diamonds. After the 2008 financial crisis, when the price of just about everything (including white diamonds) plummeted, the Argyle tender enjoyed some of its best prices ever, presumably because buyers were seeking hard assets.

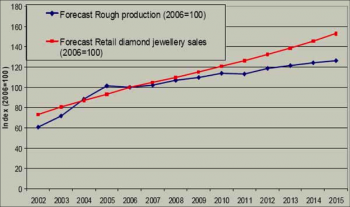

Yet, like those supply-demand charts we see for non-fancy diamonds, this logical investment thesis doesn’t always comport with reality. Even Johnson says: “We would not say, ‘Invest in these.’ ”